Centralized exchanges are at the hands of a central authority – or intermediary who oversees and controls your funds, personal details and transaction history. When trading and transacting on centralized exchanges, one should know that your funds aren’t sent P2P – or directly to another user – and must first pass through a centralized middleman, who authorizes and executes the trade on your behalf.

Decentralized Most of the people are passionate about Bitcoin and other popular cryptocurrencies. While they wish to relax, they prefer keep updated with latest informations about cryptocurrencies and merits of Centralized versus Decentralized Exchanges.

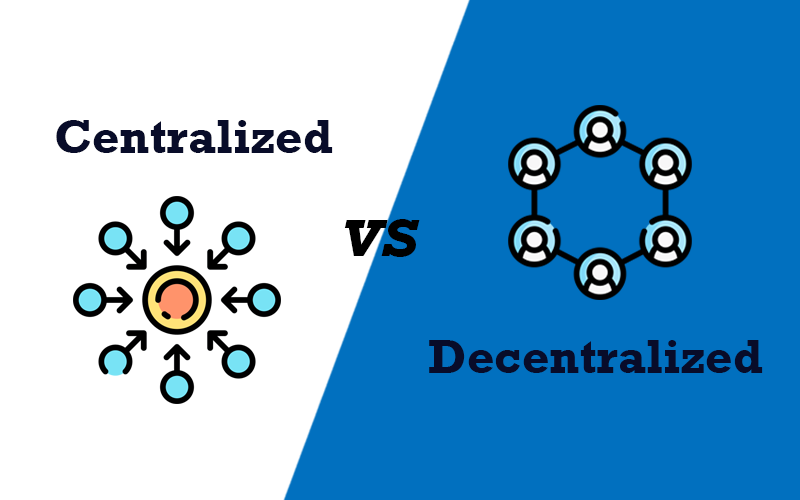

In this article we’re going to address the fundamental differences between decentralized and centralized cryptocurrency exchange script, enumerating on not only their benefits, but disadvantages as well.

Intermediaries

Centralized

The major fundamental difference between centralized and decentralized exchanges are the omittance of an intermediary and centralized third-party. Decentralized exchanges (DEXs) professionally operate on a peer-to-peer (P2P) basis, thus meaning they utilize a combination of smart contracts and payment mechanisms to execute cryptocurrency trades. So think of centralized exchanges as connecting users and traders to an entity, while decentralized exchanges connect traders to other traders.

Volume & Liquidity

Centralized

Centralized exchanges are higher volume and liquidity due to the fact that they boast a user-friendly interface and ability to fill orders instanty. Centralized exchanges ease novice investors and traders into their foray into crypto, by permitting them to easily buy and sell their favorite cryptocurrencies. Presently some centralized exchanges are facilitating billions of dollars in volume per day, making them lucrative option for users looking to instantly have their orders filled.

Decentralized

DEXs user interface is less friendly and might seem daunting for novice investors. So decentralized exchanges typically have a smaller user-base, and thus, lower liquidity and trading volume. Also it’s not a guarantee your order will be filled instantly. In conclusion the decentralized exchanges only permit for the exchange of cryptocurrency to cryptocurrency, and don’t permit users to directly purchase altcoins or cryptos with fiat (USD, EUR, SGD).

Trading & Transaction Times

Centralized

Centralized exchanges hold their listed cryptocurrencies in their actual custody, it makes for a smoother process when trading them. Since the ability to fill orders in a timely manner, margin trading is familiar on centralized exchanges.

Decentralized

The decentralized exchanges process substantially less orders per second than centralized exchanges due to the requirement to validate each transaction on the blockchain. DEXs have significantly lower daily trade volumes. The decentralized exchanges grow and users begin to acquaint themselves with the security benefits and token diversity of DEXs, finally volume and transaction times would certainly increase.

Security & Up-Time

Centralized

Security is the main drawback to using a centralized cryptocurrency exchange. Since the whole platform and exchange depends on central servers controlled by a company, there exists failure meaning users could lose their funds wholly or not be able to access them for long periods of time.

Decentralized

Decentralized exchanges operate in a peer-to-peer fashion, meaning users are connected to one another, so there’s little worry about not being able to access one’s funds or having them stolen. Moreover DEXs don’t typically require personal details or other identification, keeping users well protected and shielded from having their identity compromised. Finally the users looking to promote and experience such firsthand are turning to decentralized exchanges.

0 Comments